10 illegal Medigap selling practices you should watch for in Florida and nationwide

Call the Inspector General's hotline if you believe a federal law has been broken, like if someone tries to:- Pressure you to buy a Medigap policy or lie to get you to switch to a new company or policy.

- Sell you a second Medigap policy when they know you already have one. (They can sell you a policy if you state, in writing, that you plan to cancel your existing policy.)

- Sell you a Medigap policy if they know you have Medicaid, except in certain situations.

- Sell you a Medigap policy if they know you're in a Medicare Advantage (MA) Plan. (They can sell you a policy if your MA plan coverage will end before the Medigap policy's effective date.)

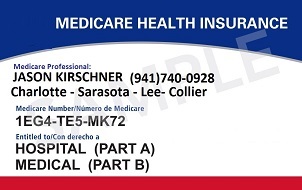

- Claim that a Medigap policy is part of the Medicare program or any other federal program. Medigap is private health insurance.

- Claim that a Medicare Advantage Plan is a Medigap policy.

- Sell you a Medigap policy that can't legally be sold in your state. Check with your State Insurance Department to make sure the policy you’re interested in can be sold in your state.

- Misuse the names, letters, or symbols of these:

- U.S. Department of Health & Human Services (HHS)

- Social Security

- Centers for Medicare & Medicaid Services (CMS)

- Any of their programs, like Medicare.

For example, they can't suggest the Medigap policy has been approved or recommended by the federal government

9. Claim to be a Medicare representative if they work for a Medigap insurance company.

10. Sell you a Medicare Advantage Plan when you say you want to keep Original Medicare and buy a Medigap policy. A Medicare Advantage Plan isn't the same as Original Medicare. If you enroll in a Medicare Advantage Plan, you'll be disenrolled from Original Medicare and can't use a Medigap policy.

If you suspect that you have been a victim of any of these illegal Medigap practices, you should contact your state insurance department or the Medicare program immediately. They can investigate the situation and take appropriate action to protect your rights as a consumer.