Medicare Advantage also known as (Part C)

Medicare Advantage Plan enrollment as an alternative way seniors in Florida to receive Original Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare approved private companies that must follow rules set by CMS. Medicare Advantage plans are required to offer the same benefits as Original Medicare, but they may also offer additional benefits such as vision, dental, and prescription drug coverage.

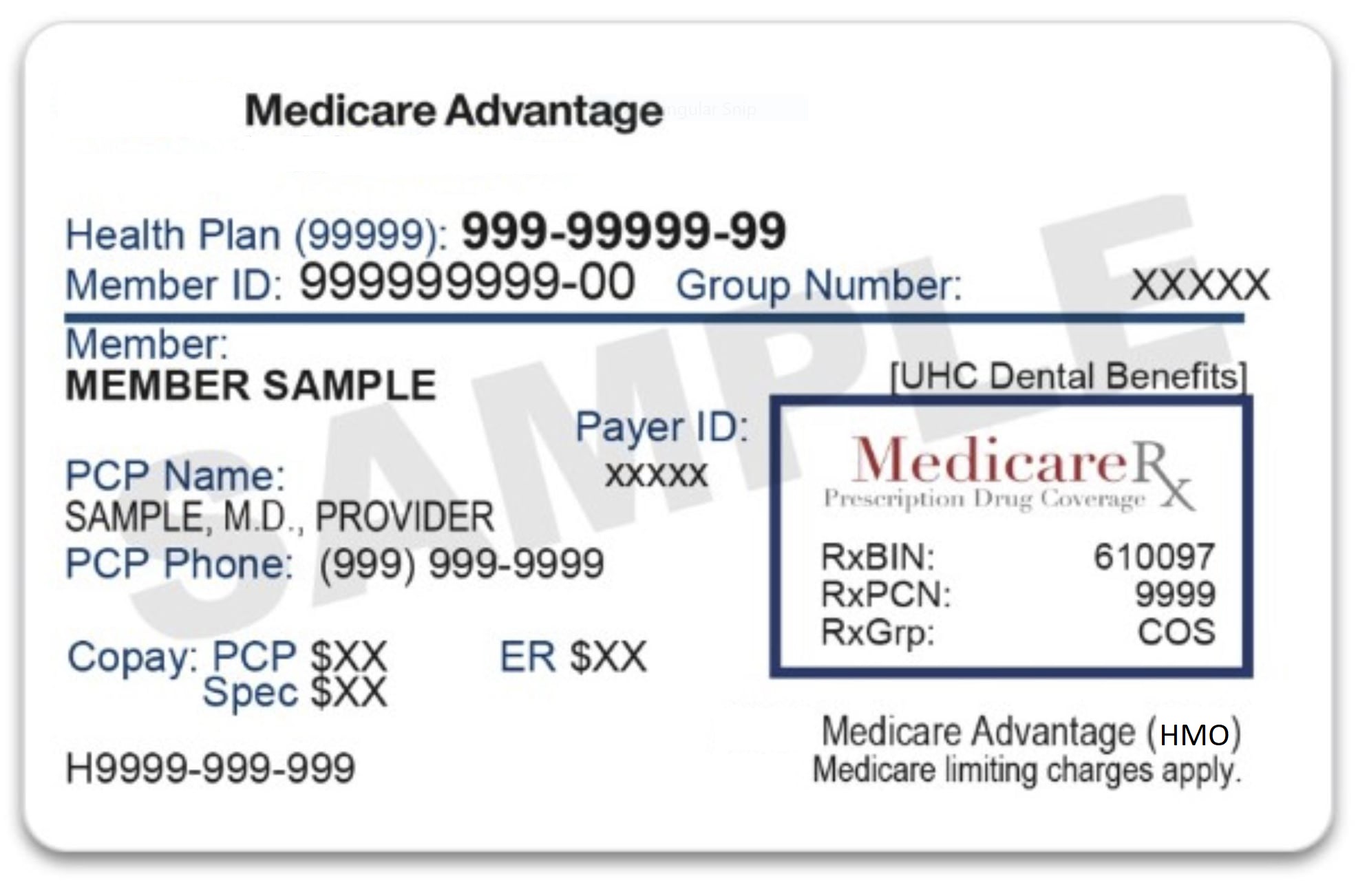

Most Medicare Advantage Plans in Florida include drug coverage (Part D). In most cases, you'll need to use health care providers who participate in the plan's network. These plans set a limit on what you'll have to pay out-of-pocket each year for covered services. Some plans offer non-emergency coverage out of network, but typically at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because you may need to use your Medicare card for some services. Also, you'll need it if you ever switch back to Original Medicare.

Florida beneficiaries enrolled in both Parts A and B can join any of these type Medicare Advantage Plans if available in your area:- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for Service (PFFS)

- Medical Savings Account (MSA) Plan

To enroll in a Medicare Advantage plan, you must be eligible for Medicare Part A and Part B, and you must live in the service area of the plan you wish to join. You also typically need to pay a monthly premium for the Medicare Advantage plan, in addition to your Part B premium.

Medicare Advantage plans may have different rules, restrictions, and costs than Original Medicare, so it's important to carefully review the plan details before enrolling. Some plans may require you to use network providers, may have restrictions on certain medical services, and may have different out-of-pocket costs for different services.

10 Things to know about Medicare Advantage

- You must continue to pay your Medicare Part B premium. Medicare then gives your premium to your Medicare Advantage plan to help pay for your additional coverage.

- Medicare Advantage has you covered. medicare Advantage plans must cover all the services that Original Medicare covers and may offer additional benefits. Important : Hospice care is still covered under Original Medicare.

- Joining a Medicare Advantage plan may affect your current coverage. If you have existing coverage or employer-provided health insurance and plan to work past 65 in Florida, check to see how joining a Medicare Advantage plan could affect or cancel your current coverage.

- It's best to use network providers. Use of network health care and pharmacy providers is typically required. Using providers outside of the network may cost you more. In an emergency, you can use any provider.

- You may qualify for financial assistance. Depending on your financial situation, you may qualify for help paying your plan premiums or Part D medications through a low-income subsidy or Extra Help.

- If you enroll in Part D late, you may pay a penalty.

This is an additional amount charged by Medicare that will be added to your Part D premium if you didn't enroll in prescription drug coverage when initially eligible for Medicare and didn't have other credible drug coverage to qualify for enrollment during a Special Enrollment Period, or you didn't enroll in prescription drug coverage within 63 days of losing your credible drug coverage. - A Medicare Supplement insurance plan (Medigap policy) is not a Medicare Advantage plan. Medicare Supplement plans are health insurance policies and are secondary to Original Medicare. Medicare Advantage plans combine Original Medicare Parts A and B, and often Part D, into a single plan.

- Keep your member ID card handy. Members must present their carriers member ID card, not their Original Medicare card, when receiving services.

- Medicare Advantage offers the same protections as Original Medicare. Even though Medicare Advantage plans are privately administered, you still have the same rights and protections as with Original Medicare.

- You have a built-in financial safety net. Your plan's annual out-of-pocket maximum is your safety net that ensures you'll never pay more than a certain amount out of pocket in a given plan year for covered medical services.