Medicare Advantage plans offered by private

companies:

Medicare Advantage Plans are another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

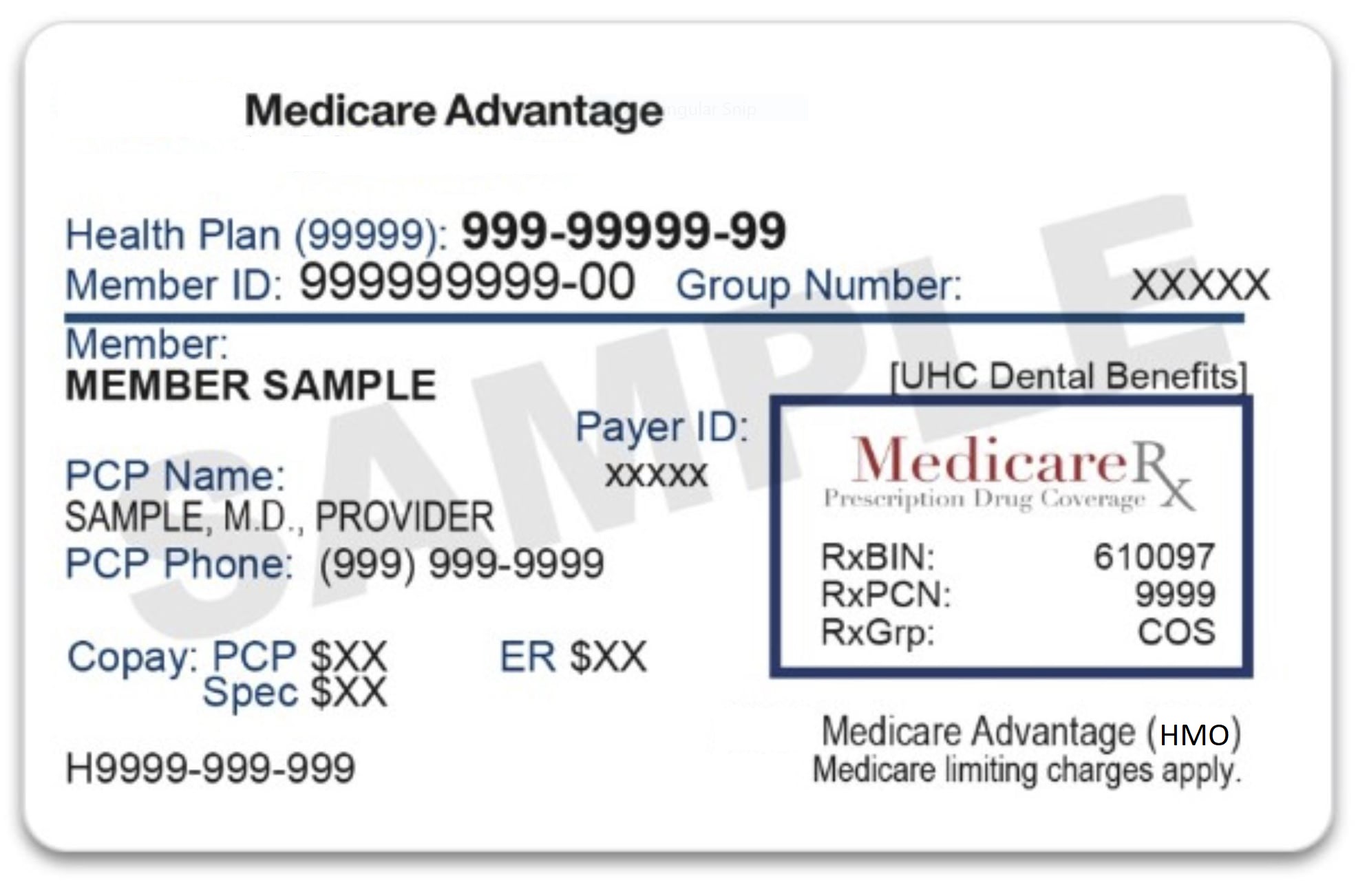

These "bundled" health plans include Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance), and usually Medicare drug coverage (Part D).

- Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Covered services in Medicare Advantage Plans

With a Medicare Advantage Plan, you may have coverage for things Original Medicare doesn't cover, like fitness programs (gym memberships or discounts) and some vision, hearing and comprehensive dental service allowances. Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness. Plans can also tailor their benefit packages to offer these benefits to certain chronically-ill enrollees. These packages will provide benefits customized to treat specific conditions. Check with the plan before you enroll to see what benefits it offers, if you might qualify, and if there are any limitations.

Rules for Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different out-of-pocket costs for health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance. They can also have different rules for how you get services, like:

- Whether you need a referral to see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change every year.

Costs for Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, you'll need to use health care providers who participate in the plan's network. Some plans won't cover services from providers outside the plan's network and service area.

Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for all Part A and Part B services. Once you reach this limit, you'll pay nothing for services Part A and Part B cover.

Drug coverage Medicare Advantage Plans

Most Medicare Advantage Plans include prescription drug coverage (Part D. You can join a separate Medicare drug plan with certain types of plans that:

- Can't offer drug coverage (like Medicare Savings Account plans)

- Choose not to offer drug coverage (like some Private Fee-for-Service plans)

You'll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply:

- You're in a Medicare Advantage HMO or PPO.

- You join a separate Medicare drug plan.

| Note:

If you join an HMO or PPO that doesn't cover

drugs, you can't join a separate Medicare drug

plan. In this case, either you'll need to use

other prescription drug coverage you have (like

employer or retiree coverage), or go without drug

coverage. If you decide not to get Medicare drug coverage when you're first eligible and your other drug coverage isn't creditable prescription drug coverage, you may have to pay a late enrollment penalty if you join a plan later. |

How Medicare Supplement Insurance (Medigap) policies work with Medicare Advantage Plans

You can't buy (and don't need) Medigap while you're in a Medicare Advantage Plan. You can't use Medigap to pay for any costs (copayments, deductibles, and premiums) you have under a Medicare Advantage Plan.

- Copayments: An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay or for a doctor's visit or prescription drug.

- Deductibles: the amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay.

- Premiums: The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.