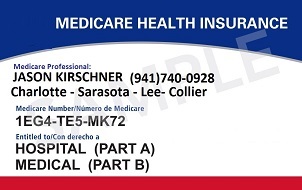

People with Original Medicare can buy private health insurance policies that help cover some of the out-of-pocket costs that are not covered. These shared costs would be deductibles, copayments, and coinsurance payments that otherwise would be the responsibility of the beneficiary. These Medigap policies are sold by private insurance companies and can be purchased by seniors aged 65 in Florida who are enrolled in both Medicare Parts A and B.

There are 10 standardized Medigap plans available in most states, labeled with letters A through N. Each plan offers a different combination of benefits, with Plan A being the most basic and Plans F and G being the most comprehensive. Regardless of the insurer, each plan of the same letter must offer the same benefits.

It's important to note that Medigap policies do not cover prescription drugs. If you need prescription drug coverage, you will need to enroll in a separate Medicare Part D plan.

In addition, Medigap policies do not cover services that Medicare does not cover, such as dental, vision, and long-term care. However, some policies may offer additional benefits, such as coverage for emergency medical care while traveling outside of the United States.

| Note |

| Note: Medigap plans sold to people age 65 and over in Florida and new to Medicare can no longer cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020. However, if you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans that cover the Part B deductible (Plan C or F). If you already have or were covered by Plan C or F (or the Plan F high deductible version) before January 1, 2020, you can keep your plan. |

Things you need to know about Medigap policies

- You must have and maintain Medicare Part A and Part B.

- This type of policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

- You pay the private insurance company a monthly premium for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare.

- They only covers one person individually. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

- You can buy one from any insurance company that's licensed in your state to sell one.

- It’s important to compare the different policies since the costs can vary between plans offered by different companies for exactly the same coverage, and may go up as you get older. Some states limit Medigap premium costs.

- Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can't cancel your Medigap policy as long as you pay the premium.

- Medigap policies can no longer be sold with drug coverage, but if you have an older Medigap policy that was sold with drug coverage (before January 1, 2006), you can keep it. You may choose to join a separate Medicare Prescription Drug Plan (Part D). because most Medigap drug coverage isn’t creditable prescription drug coverage , and you may pay more if you join a drug plan later. If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums.

- It's not compliant for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

It's important to note that Medigap plans are not the same as Medicare Advantage plans, which are an alternative way to receive your Medicare benefits. If you have questions about Medigap and whether it is right for you, you should speak with a McCunis-Fox / 65 in Florida licensed insurance agent.